*Updated version: January 2018

Our family's budgeting journey began like most people's...deep in depression + survival mode. Late one October night, after my kids fell asleep, I sat at my computer scared + desperate for change. I can still remember all of the emotions I felt as I googled, searching for something to save us. It was one of those moments when you use your last bit of oxygen to scream for help. I was that desperate.

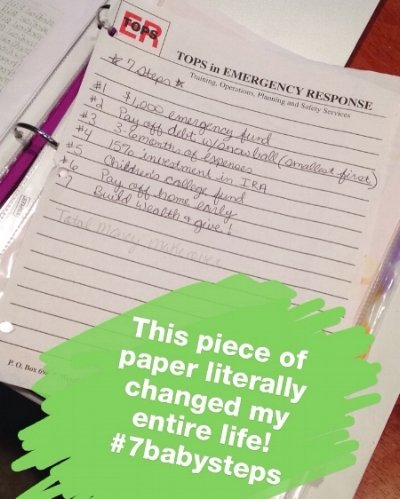

As I nervously typed “budgeting help” into the Google search, I had no idea what I was getting my family into. When some guy named Dave Ramsey popped up, I grabbed the closest piece of paper and cautiously wrote down his baby steps.

As I read the Baby Steps out loud to my husband later that night I was filled with overwhelming ambition. I knew we had tried budgeting before and failed. I knew that we had said “we really need to get it together” a million times. I knew that everyone would doubt us. I knew it would be hard. I knew all of these things...but I also knew that this time was different.

As Dave says, we were sick and tired of being sick and tired!

As I said, this time was different! We were parents of two, we were literally drowning in debt, we weren't even living paycheck-to-paycheck anymore. We were consistently over-drafting our bank account every pay period. We had stopped answering the phone for random numbers. Our marriage was crumbling because of the stress. Our entire lives were spiraling out of control.

The next 3 months we halfheartedly tried to stay on budget. We decided to cut back on eating out and extra spending...especially after I reviewed our past 3 months worth of bank statements that told me that we were consistently spending around $800 a month on wasteful purchases.

READY TO GET INTENTIONAL

WITH YOUR SPENDING?

Break free from living paycheck-to-paycheck

...an abundant life is waiting for you!

We caught up the payments on our rent house, after our loan officer called to inform us that repossession papers had just came across his desk. I was so disorganized that I honestly didn’t even know that we were almost 3 months late on the payments. Not to mention the property taxes that we were almost 3 years behind on! He told us since he was a friend of the family, and had known us since we were teenagers, that he’d give us a few weeks to get the payments caught back up. This lit a fire under us, as you can probably imagine.

However, due to these circumstances, we didn't exactly follow Dave's Baby Steps to a tee...but they did lay a great framework for us to get started.

Like a lot of people, the hardest concept for us to grasp was saving a small emergency fund before we started knocking out our debt. We were really stubborn with this step + really wanted to just skip it all together! We did end up savings a few hundred dollars, but not the full $1,000 that Dave recommends.

Again, we interrupted his Baby Steps in our own way and paid off 2 credit cards, that were not our smallest debts, totaling around $2,000 with some holiday pay my husband made that year by working the weeks of Christmas + New Years. Even though these were not our smallest debts, they were weighing on us the most, and we felt the most motivated by paying them off first. Now, as a Budgeting Coach myself, I often use this example to show my students that the most important aspect of budgeting is making it unique to your own family....I've found that's the true key to success!

We were so proud that we had paid off that little bit of debt and slowed down on our spending, that we were finally ready to take our journey to the next level! By this point it was January 2015. A new year was upon us...and I always love the spirit of inspiration that a new year brings! We also had the promise of our income tax return in just a few weeks that I knew would be perfectly timed to help us kick this into high gear!

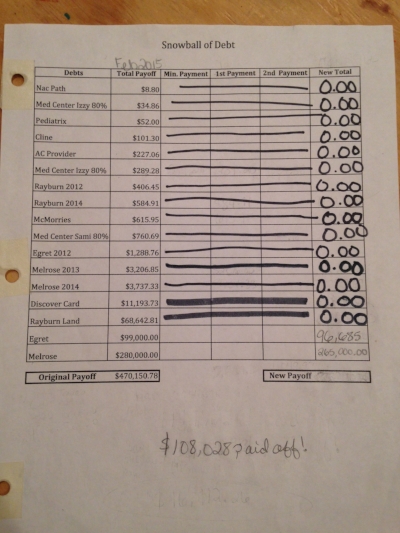

As I sat at our kitchen island starring at a blank excel spreadsheet I decided it was time to get serious, so that night I made our very first Debt Snowball chart. (You can grab my Free Debt Payoff Worksheets for yourself here!) It was at this point, three months into budgeting, that we were finally fully committed!

After taking what felt like a million punches in stomach, I added up our total debt. $470,150.78 is what the total came out to be that night. This wasn't counting the $2,000 that we had already paid off, a few other debts that we came across later + our soon to be born third daughter’s medical bills...all of which brought our grand total to about $490,000!

That night was, as you can imagine, insanely painful! As I lined up our debts smallest to largest, Debt Snowball style as Dave suggests, I realized that our three smallest debts totaled under $100, and I paid them off that night. All three of them were remnants of medical bills left over from when our second daughter, Izabell was born…a year earlier! Why had I hung on to them for so long?

Our original Debt Snowball Chart. (January 2015)

My husband wasn't quite as on board as I was yet, but even with him having his doubts we were at least communicating about money better than we ever had in our 6 years of marriage. We learned how to talk through our major purchases and started discussing spending without fighting.

We had a great plan and everything was looking so promising...then we got the surprise of a lifetime! We were pregnant again! Honestly, my first reaction was not a happy one. I was scared to death of losing our brand new motivation, I sat and cried for a solid 4 days. I thought, “Why now? We just started! Were we not meant to succeed at this?”

Little did we know, the surprise of our third daughter would become the ultimate motivation to get this debt gone once and for all! We now had a deadline!

Our income tax return money finally came in, and this was the first year that we didn’t blow all of it within a week. As soon as we found out how much the return money would be, I sat down and made a plan for it. We felt like we had won the lottery! We were motivated, we had a plan, and now we knew how to tell our money where to go.

After learning our lesson the hard way, we finally decided to bump up our savings to a full $1,000 (Baby Step #1) + then we got serious about paying off our debts from smallest to largest (Baby Step #2).

We decided we wanted to save up and cash flow our 3rd daughter, Melanie’s birth. So I budgeted ahead for the rest of the year (my husband’s pay schedule is usually pretty predictable) and I planned out every single thing that I could think of. I figured out that we had plenty of time to save up for her birth, as well as some money for an extra flight home and almost a week’s worth of missed work for my husband (something that was not possible with our other two daughters).

We continued to work on our debt snowball a little bit longer and got some more small debts out of the way during the first few months of her pregnancy. Around the 3rd or 4th month we finally started throwing every dollar into our savings account to hit that goal amount before she was born. We ended up reaching it an entire paycheck ahead of time, and she was born with a savings account of over $6,000.

>>> Rewind for a minute to when our second daughter, Izabell, was born, 20 months earlier. My husband flew home only hours before she was born. We had to max out our credit card to pay for the flight (I consider this our rock bottom moment). We had zero dollars in savings...in fact, we didn't even have a savings account at the time. My husband had to rush back to work when she was only 2 days old. And her medical bills piled up for over a year, with a few even getting sent to collection.

Everything about Melanie’s birth was more relaxed and planned. We were beginning to feel what Dave Ramsey calls “Financial Peace”. Birthing a baby into financial chaos only brings more chaos, birthing a baby into financial peace only brings more peace. We experienced both scenarios within those two short years.

Us with Melanie (October 2015)

Dave always tells his listeners that when you have a major life event, such as a move, job loss, or the birth of a baby, to push pause on your debt snowball and stockpile money. After you’re settled from that major event you can hit play again and get back to tackling your debt. That’s exactly what we did. The dust of welcoming our third daughter settled, and we even ended up actually over saving...by some miracle...and we had a little bit of money left over!

It was October again by the time Melanie was born, it had been a full year since we took control of our lives. We continued to chip away at our debts and they were getting smaller and smaller! We had our second Christmas on a budget, this one we bumped our budget up from $500 to $600 for our family of about 20 adults and 3 kids.

Another New Year started and more good news came our way! Our commercial land that had been for sale for about 5 ½ years finally had a buyer! We had planned and dreamed for years about what we do when we finally had this money. But by the time the money actually rolled around, we hardly even needed it! As they say, God’s timing is always correct! We knew that if the old us would have gotten this money that we would have wasted it, and now we could do so many good intentional things with it instead.

It took almost 4 months to finally close on the sale of the land, and by then tax return time had came. With that year’s return we paid the final payment on our last consumer debt...our much despised Discover Card! That Discover Card was the same one that we had maxed out the day before Izabell was born with a total of over $11,000! Our hatred for this one card in particular is what prompted us to take all of our paid off cards, cut them up into tiny pieces, and blow them up with an explosive material called Tannerite. (See our video below)

Finally the land sale was complete! We paid off the remaining balance on its loan, saved money back for a 5 month emergency fund (Baby Step #3), and soon after bought our second vehicle in cash! This second vehicle was 9 years old with over 170k miles, but we had honestly never been more proud of a material object in our entire lives; because for once, it was all ours!

Me with our "new" Suburban (May 2016)

Sweet sweet freedom! I cannot even begin to put into words how we felt. It’s an experience that I can only say was worth all of the tears, worth all of the coupons clipped, worth all of the skipped restaurant dinners, worth all of the other hundreds of sacrifices...it was worth it all!

We kept saving + living below our means for the rest of 2016, and in the Spring of 2017 we were able to cash flow our first real luxury item, a 24-year-old family boat! This boat had been the goal that finally got my husband on board with this budgeting thing, and kept us going on the hard days...and it was finally ours!

At this point our only debts left were our rent house + our current house...both of which were for sale in the very slow housing market of East Texas. Instead of paying extra towards those mortgages, because we weren't guaranteed we'd see the return after they sold, we just kept saving as much money as possible in our regular savings account.

Bought our Boat (March 2017)

Sold our Rent House (April 2017)

Not long after this, our rent house sold, knocking out another $98,000 in debt, and leaving only our house's mortgage on our debt list.

$225,000 worth of debt was gone...we felt amazing, but we knew we weren't done! So many reasons (which you can read about here) led us to the choice to sell our house to become 100% debt free. It wasn't an easy decision, but it ended up being the perfect decision for our family!

After almost a year and a half with our house on the market it sold in January of 2018! The shock was unreal, and it took a few days, maybe even weeks for the whole thing to sink in.

Now, we were ready to get serious about investing in our retirement accounts (Baby Step #4) + savings for our kids' college (Baby Step #5). I will note that we continued to contribute 5% to my husband's 401k throughout this entire journey because we got an employer match, but we'll soon be bumping up our investments another 10% through Roth IRAs + mutual funds.

As for our plans for the future...

We're currently renting a small 2 bedroom house (with 3 kids + a dog) to save some money and continue to live on about 50% of our income for probably another year or so. We plan to cash flow an upgrade in truck for my husband very soon, and also cash flow a large camper hopefully in the next year so we can do some traveling.

Our long term goals are to retire my husband from his off-shore Merchant Marine job in less than 10 years + build our dream custom home here in East Texas. As well as, continuing to chase our dreams of travel + intentional time as a family, and of course giving to others generously (Baby Step #7).

So, that’s our walk up the Baby Steps so far! No, we didn't always follow Dave's plan perfectly, but we made it work for our family!

There are so many other little details that I had to leave out for time’s sake. Details about things we cut out to save money, times that we screwed up along the journey, and times we wanted to quit.

Was it easy? NO! Would we do it again? A million times...only, we we wish we would have started sooner! If you're ready to get started on your own journey don't wait like we did! Get started now! Check out my resources for helping you get started below...

> Free 5-Day Email Course

> Free Debt Payoff Worksheets

> Full set of Budgeting Worksheets

> Full Budgeting Course, Your Sunny Money Method

HEY I'M SAMI WOMACK

I'm the wife to my high school sweetheart, Daniel, + homeschooling momma to our 3 girls. I'm the Budgeting Coach + Motivational Speaker behind

A Sunny Side Up Life.

My family used to be in $490k of debt + living paycheck-to-paycheck, but after we hit rock bottom everything changed for us!

Now that my family has become debt free + gained financial freedom, I want to help your family do the same! My passion is inspiring women to live abundant lives through budgeting, intentional living, and positive thinking.

I offer a jump start into budgeting with my free 5-day email course + a full budgeting experience with my course, Your Sunny Money Method.

Continue reading related articles: