by Guest Author: Bradie Claydon from Kiwi Girl On A Budget

Hi everyone and welcome to my story to financial freedom.

To begin, let me introduce myself, my name is Bradie Claydon and I’m 48 years old. I’m a proud Mum to three beautiful kids, Joel, Reed and Mckenzie, a Nana to Olive and Avery and Mum-in-law to be to Tauser and Nick. I am married to my wonderful husband Paul, also known as ‘Mr Frugal’.

I have always loved finances and my earliest memory is having my own budget for my pocket money from when I was around 8 years of age. I am not a financial adviser, so any information that I am about to share in the next few chapters, is my opinion only, but I’m here to share our story of how we went from having $566,380 debt to being completely debt free in 39 months.

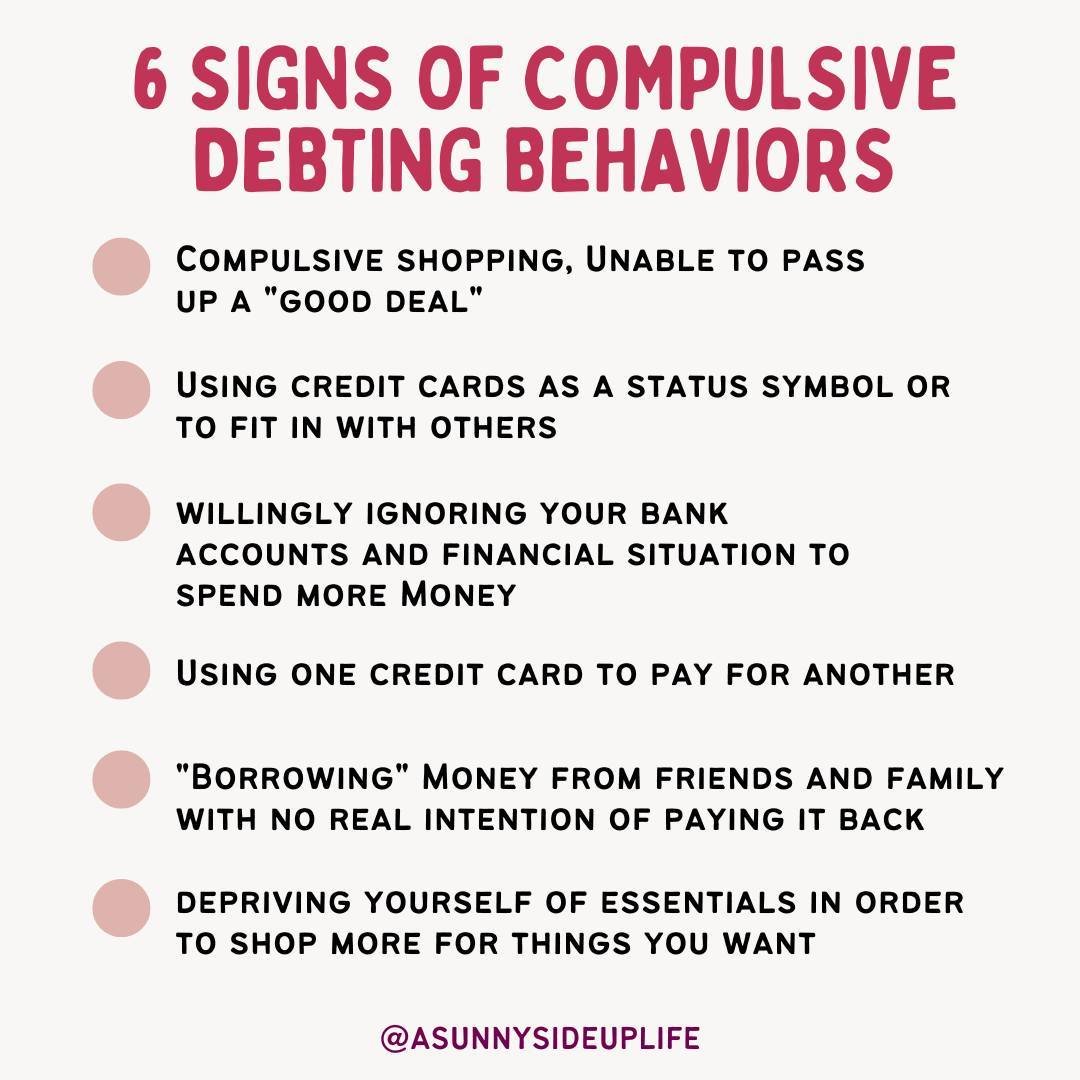

Mr Frugal and I are both now quite frugal and a bit weird and decided back in January 2016 to get real with paying off our mortgage in five years, but It wasn’t always this way. We use to be ‘normal’ and live pay check to pay check, robbing Peter to pay Paul with our bills and I use to regularly max out our credit card with things we didn’t need to impress people we didn’t know! I even went so far as putting our credit cards in the freezer ‘on ice’ to try and stop our spending (or my spending more to the point!). I was 45 and sick and tired of not getting ahead and being stressed with debt.

We began our journey in January 2016 after a few major lifetime events. I lost my beautiful sister Kim to cancer in Dec 2015 and she was just 48. This made me realize what is most important in life and that family is everything. It also taught me how important it is to be at peace and to stand in your truth.

A few weeks later I purchased a piece of art ‘Buddha’ in New Plymouth while visiting friends, with my visa card for $120.00. Mr Frugal was less than pleased (to say the least) and we ended up not talking the whole way home. I remember thinking at the time, that “it’s no big deal” but to Mr Frugal it was and I realized then we were on different pages about finances.

Another weekend a few weeks later, we went to stay in Auckland (Visa card paying everything of course) and we went to the movies to see ‘The Big Short’. This movie is all about the USA housing crash and was a real eye opener. My home is literally my “safe place” and it really made me aware that if we weren’t more astute with our finances, we could end up (worst case scenario) losing our home. We ended up talking until the wee hours of the morning about our finances and realised we weren’t paying $1 to debt, (yep not $1 of debt) as we were on a fixed, interest only mortgage. It was the final straw that broke the camels back and the wake up call I needed. Strike number 3 and I was flat on the canvas, I was beaten by debt and ready to change our ways. We started our debt free journey the next day.

First budget meeting: January 2016 we both sat down and added up all our debt - it totalled $566,380

This was a tough day, but in a sense a great day as we had ‘ring-fenced’ the debt which meant it would never get any larger. We cut up our credit cards as well and started nutting out our first budget. It took us about 3 months to master our ‘budget’ where we got down to only our needs and got rid of the wants and then we moved into ‘sell mode’. We sold our rental property for $315k (this took us around 9 months) which was instrumental in setting us on our way - we borrowed 100% finance to purchase this property so clearly couldn’t afford it! We also sold our SUV for $15k and bought a second-hand Toyota Corolla for $8k. By the end of 2016 we had paid off a staggering amount of $402k of debt.

I started an Instagram page called ‘kiwigirlonabudget’ to keep me focused on our debt free journey and I posted everyday sharing my adventure along the way. I was seen as inspirational and different – putting my truth out there about what I have learnt along the way. This platform has kept me focused and inspired not to mention some of the people I have been introduced along the way.

By January 2017 (one year later), we were a team possessed and were living off one wage and the other went all onto the mortgage. We also did as many shifts and side hustles as we could. We refined our budget to an inch worth of its life, saving on groceries by meal planning and shaving all our expenses. I was running a tight ship and loved it. Every dollar we earnt was working for us instead of for the “man”. By the end of 2017 we had paid off another $52k debt and had a balance of $112k left.

2018 was the penultimate year of our journey - we had decided to include a bit more fun after working so hard in 2017 and so we planned and paid for in cash, a celebration weekend for the whole family at the end of March staying at a 5 star Hotel in Auckland City (to celebrate cracking under $100k) and we also enjoyed a holiday in Noosa for a week in August for Mr Frugal and myself to rest and recuperate. We stayed at an AirBnb and budgeted our meals. We spent a total of $2000 (included airfares and accommodation – not bad !). We were making $10,000.00 lump sum payments every 3-4 months as our payments were the highest the Bank would allow. We were charged a small break fee of around $60-80 to make a “partial break” but this didn’t stop us, we were on a mission. We didn’t slow down our debt repayments though and even ramped it up a cog, in 2018 we paid of a staggering amount of $85k and our balance was $27,000 by the end of the year.

2019 The final year of our journey and we became debt free on 17th April 2019. We have booked a break to Waiheke Island to celebrate and then later in the year we have booked and paid for our whole family holiday to fly to magical Queenstown in the South Island of New Zealand. It’s been such a relief to reach our final destination and our debt free date. After so long of being gazelle intense, we are looking forward to relaxing and finding our “new normal” after being so frugal for so long. We are sure going to enjoy a few treats and will keep sharing our adventures with you all along the way.

Photo from their Mortgage Payoff Day!

If you'd like to read this blog later, please save it to Pinterest.

Listen to the Podcast...

READY TO GAIN FINANCIAL FREEDOM

+ BREAK FREE FROM SURVIVAL MODE?

I'VE GOT EVERYTHING YOU NEED!

HEY I'M SAMI WOMACK

I'm the wife to my high school sweetheart, Daniel, + homeschooling momma to our 3 girls. I'm the Budgeting Coach + Motivational Speaker behind

A Sunny Side Up Life.

My family used to be in $490k of debt + living paycheck-to-paycheck, but after we hit rock bottom everything changed for us!

Now that my family has become debt free + gained financial freedom, I want to help your family do the same! My passion is inspiring women to live abundant lives through budgeting, intentional living, and positive thinking.

I offer a jump start into budgeting with my free 8-day Declutter Your Budget Challenge + full budgeting experience with my course, Your Sunny Money Method.

GET TO KNOW ME BETTER

Come follow my day-to-day life over on my Instagram Story

![[journey to mortgage freedom] blog thumbnail.png](https://images.squarespace-cdn.com/content/v1/5779e6a8be65944fd9c3ae05/1556054379914-6HPXCOZ0ISBKP11RXVCX/%5Bjourney+to+mortgage+freedom%5D+blog+thumbnail.png)