This post may contain affiliate links. Visit my disclaimer page for more info.

Since it's tax day, it's finally time to open up about my story about what happens when you're 3 years behind on property taxes, don't properly pay your business's sale tax, and when the IRS comes after you because you failed to claim all of your income.

If you're scared... well, you should be!

IN THIS EPISODE, SAMI SHARES ABOUT:

Why she was behind on her property taxes

What she did to resolve the issues

What she learned from this IRS nightmare

RESOURCES MENTIONED:

If you'd like to listen to this episode later, please save it to Pinterest.

Listen to every episode...

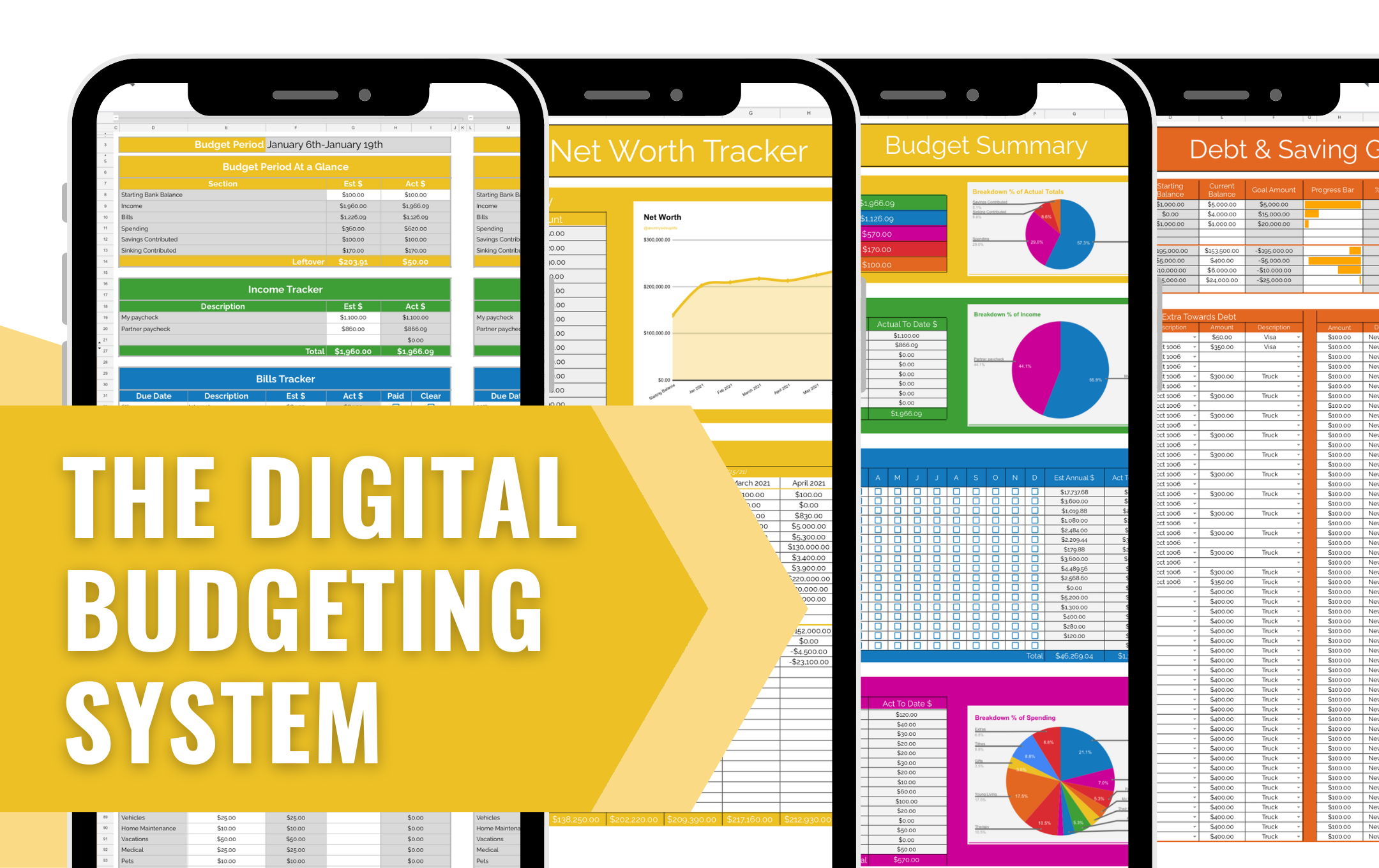

READY TO GAIN FINANCIAL FREEDOM

+ BREAK FREE FROM SURVIVAL MODE?

I'VE GOT EVERYTHING YOU NEED!

WHO IS YOUR PODCAST HOST?

Sami Womack is the brains behind A Sunny Side Up Life. Her weekly chart-topping podcast has been downloaded over 150,000 times. When she’s not downing caramel coffee and rocking a little girl on her hip (literally), she’s creating content, collaborating with finance/minimalist organizations, and inspiring women all over the world to live an intentional life.

She began this journey with her high school sweetheart, Daniel, and a debt price tag of $490,000. They both took control of their family’s finances by downsizing, budgeting, and changing habits. From this experience, A Sunny Side Up Life was born.

Today, Sami owns this business helping women get through dark times and experience the life-altering magic of intentional living.

She offers a jump start into money mindset with the FREE Magic + Money Course + a full budgeting experience with Your Sunny Money Method.

Follow Me For More Money Inspo

GET TO KNOW ME BETTER

Come follow my day-to-day life over on my Instagram Story

Disclosure: There are some affiliate links above, but these are all products I highly recommend. I won’t put anything on this page that I haven’t verified and/or personally used. Read our disclaimer here.

![[ep 134] a sunny side up life podcast thumbnail.png](https://images.squarespace-cdn.com/content/v1/5779e6a8be65944fd9c3ae05/1618416831660-AKOGEF1JOQ2B58XQYK60/%5Bep+134%5D+a+sunny+side+up+life+podcast+thumbnail.png)