This post may contain affiliate links. Visit my disclaimer page for more info.

Andy Hill, founder of the award-winning podcast and blog Marriage, Kids, and Money, joins the podcast to talk all things FIRE (Financial Independence, Retire Early) and mortgage free living..

He and wife Nicole started out their money journey with $50K in debt and paid it off in less than a year. In the next 10 years, they paid off their mortgage and built their net worth to more than a million dollars. Andy and Nicole’s story has been featured in Time, CNBC, Kiplinger’s Personal Finance, NBC News and more!

We talk about how to prepare for a looming recession, why doing what helps you sleep at night is better than what is financially optimal in some cases and the different types of FIRE.

In this episode, we chat about:

What inspired Andy to get into the FIRE Movement + How he’s forged his own (balanced) FIRE path

How to get the whole family on board with Financial Independence

The emotional and psychological benefits to paying off your mortgage early

Teaching your kids about money and passing down legacy wealth while your children are alive

Coast FIRE vs. traditional FIRE + more

MENTIONED IN THIS EPISODE:

PODCAST episode SPONSOR:

Not Another Personal Finance Podcast

past EPISODEs you’ll enjoy:

Deconstructing Money Shame, Navigating

Mental Health & Finances, And 3 Reasons Dave Ramsey Sucks With Lexa Vandamme

ASSUL RESOURCES:

1:1 Coaching With Sami: Apply today

2023 Powersheets: Goal Planner

YouTube: Subscribe for free

Instagram: Follow me on the ‘gram

Facebook: Follow me on Facebook

The Sunny Squad: Join the VIP Facebook Group

GUEST LINKS:

GUEST BIO:

Andy Hill is the founder of the award-winning podcast and blog Marriage, Kids, and Money, a platform dedicated to helping young families build wealth and happiness. He and wife Nicole started out their money journey with $50K in debt and paid it off in less than a year.

In the next 10 years, they paid off their mortgage and built their net worth to more than a million dollars. Andy and Nicole’s story has been featured in Time, CNBC, Kiplinger’s Personal Finance, NBC News and more!

When he's not talking money, he enjoys watching his kids play soccer, singing karaoke with his wife and watching Marvel movies.

SHOW INFORMATION: A Sunny Side Up Life

A Sunny Side Up Life Podcast is a show for women who are ready to live an abundant life full of freedom + positivity. Sami Womack, nationally recognized money expert and finance coach guides listeners toward breaking free from survival mode, gaining financial freedom, staying motivated, and focusing on what matters most.

CREDITS:

Podcast Support: Weir Digital Marketing

Podcast Artwork: Weir Digital Marketing

Audio Engineer: Garrett Davis

Listen to every episode...

what kind of support do you need?

WHO IS YOUR PODCAST HOST?

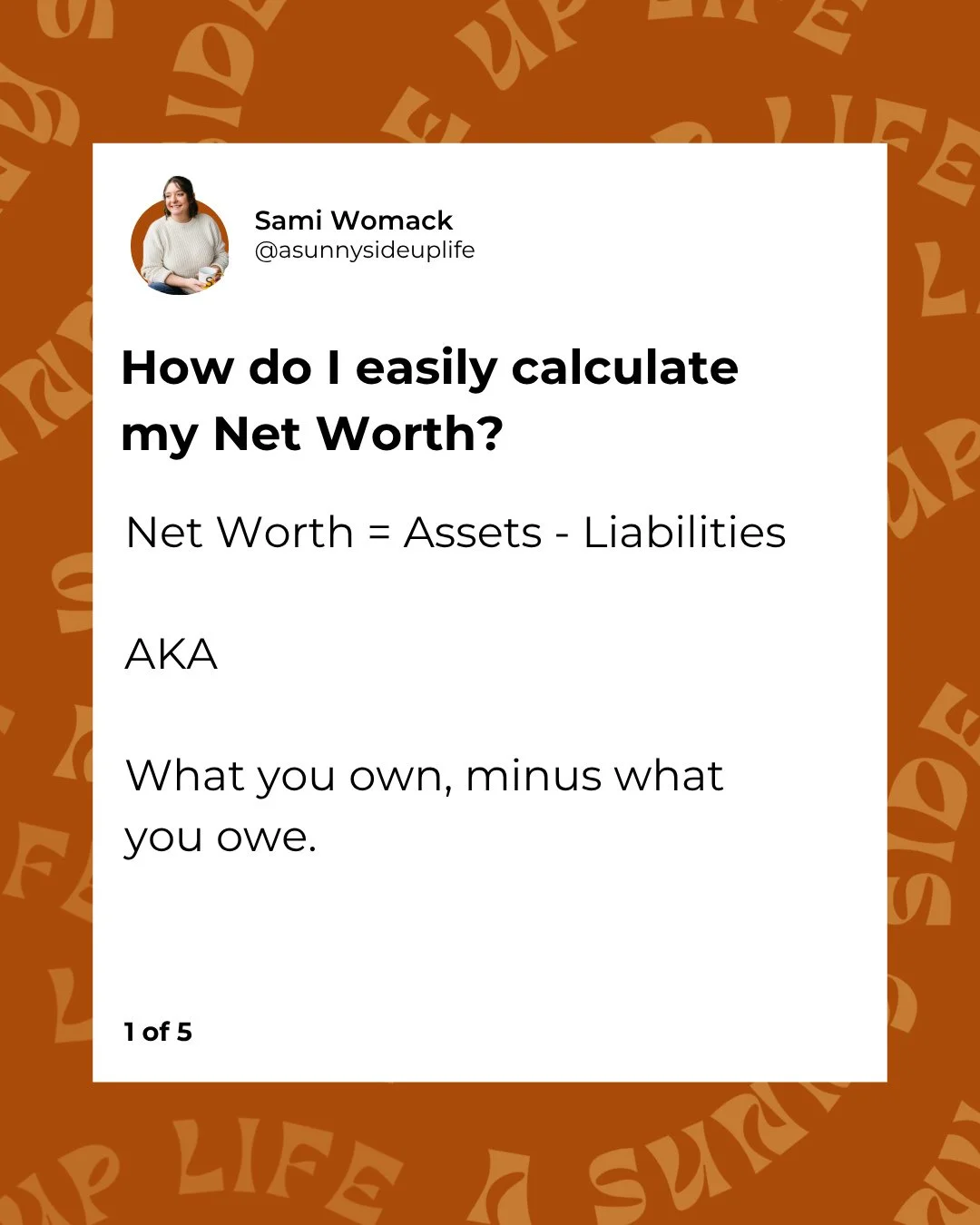

Sami Womack is the brains behind A Sunny Side Up Life. Her weekly podcast has been downloaded over 250,000 times, and her story has been featured on YNAB, Debt.com, The Purpose Show with Allie Casazza, and The His & Her Money Show. When she’s not downing caramel coffee or homeschooling her daughters, she’s creating content, collaborating with finance/minimalist organizations, and inspiring women all over the world to live an intentional life.

She began this journey with her high school sweetheart, Daniel, and a debt price tag of $490,000. They both took control of their family’s finances by downsizing, budgeting, and changing habits. From this experience, A Sunny Side Up Life was born.

Today, Sami owns this business helping women get through dark times and experience the life-altering magic of intentional living.

She offers a jump start into budgeting a FREE 5-Day Challenge + a personalized experience with 1:1 Budget Coaching.

Follow Me For More Money Inspo

GET TO KNOW ME BETTER

Come follow my day-to-day life over on my Instagram Story

Disclaimers: This show may contain affiliate links or links from our advertisers where we earn a commission or direct payment.

Opinions are the creators alone. Information shared on this podcast is for entertainment purposes only and should not be considered as professional advice. Read our full affiliate disclaimer here.